2022 annual gift tax exclusion amount

Each year theres a set annual exclusion for gift tax. If your spouse is not a US.

What is the gift tax annual exclusion amount for 2022.

. Dec 31 2022 Last day to. The IRS allows you to gift a certain amount of money or property to someone before the gift tax kicks in. Last 2022 trade date is December 30.

The tuition gift tax exclusion allows grandparents and other individuals to reduce their taxable estate while helping a child a child pay for college. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. Annual gift tax exclusions.

1 pay expenses for itemized deductions for 2022. In 2021 it was 15000 per person and in 2022 its 16000 per person. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

For 2014 the annual exclusion limit is 14000 per person. You can give up to this amount in money or property to any individual per year without incurring a gift tax. This applies both to each gifter and to each.

There is no lifetime gift tax credit available to offset tax where such gifts result in a tax liability. To better support independent living Budget 2022 proposes to increase the annual expense limit of the Home Accessibility Tax Credit to 20000. The value of the credit is calculated by applying the lowest personal income tax rate 15 per cent in 2022 to an amount that is the lesser of eligible expenses and 10000.

2022 and federal income tax return extension was filed for such business. The tax rate applicable to transfers above the exemption is currently 40. Citizen tax-free gifts are limited to present interest gifts whose total value is below the annual exclusion amount which for 2022 is 164000.

2 complete transactions for capital gains or losses. Grandparents do not have to file a gift tax form when money is paid directly to a college even if the amount exceeds the 15000 annual exclusion amount. That means you can give your student up to that amount directly without having to worry about paying the gift tax.

Gifttax annual exclusion 16000 Estate gift generation skipping transfer tax exclusion. Your gifts can total 32000 for the year if you want to give two people each the annual. How the Annual Gift Tax Exclusion Works.

The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount. If you have more than one child youre allowed to gift each of. As far as the IRS is concerned the only relevant factor is the items fair market value basically how much the gift is worth.

Irs Announces Higher Estate And Gift Tax Limits For 2020

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Jersey Gift Tax All You Need To Know Smartasset

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Historical Estate Tax Exemption Amounts And Tax Rates 2022

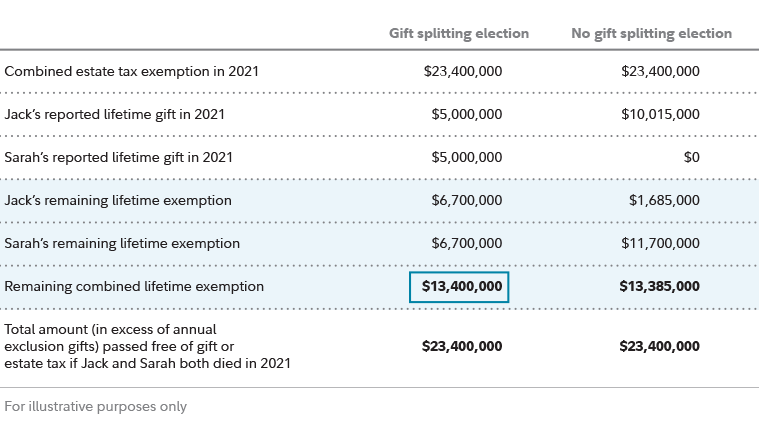

Estate Planning Strategies For Gift Splitting Fidelity

What Are Estate And Gift Taxes And How Do They Work

2022 Changes To Estate And Gift Tax Exclusions Cole Schotz Jdsupra

Connecticut Gift Tax All You Need To Know Smartasset

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Estate And Gift Tax An Overview Findlaw

The Annual Gift Tax Exclusion H R Block

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What You Need To Know About Stock Gift Tax

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)